ESG Methodology Madness

Maybe you can relate to my love/hate relationship with Ikea? Things start to go awry when I’ve unpacked the contents of a bunch of boxes and sort-of organised them to check against the printed instructions… it’s then that I get an uneasy feeling, will there be anything left over once I’ve finished? Did they pack spare screws? I count as well I can, but I’m afraid I’ll miss something… those little plastic bags are not as transparent as they could be.

And then there is the instructions. Some sheets of paper with diagrams that mostly make sense, but there is always one that seems to be designed to confuse. It’s got lots of screws and lines going into holes that sometimes aren’t there. I start wondering about the person who made the instructions, did they actually build the thing? My stomach sinks, it’s time to begin if I’m going to be finished anytime before midnight.

I hear similar stories from sustainability managers time and again. Only this time, I’m the one who has written the instructions.

Making the Right Choice

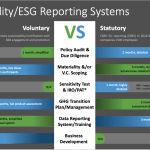

As companies increasingly cope with Environmental, Social, and Governance (ESG) reporting, the pressure to choose the right methodology has intensified. ESG reporting has become a critical component of corporate sustainability and accountability, shaping investment decisions, stakeholder perceptions, and regulatory compliance. The selection of an appropriate methodology involves navigating a complex landscape of standards, frameworks, and guidelines. This process is fraught with stress and pressure due to the potential consequences of making a mistake. What is the right ESG reporting methodology? And what are the potential impacts of making errors in this crucial process?

It’s a Complex World Out There

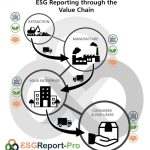

The landscape of ESG reporting methodologies is intricate and multifaceted. Various organisations and initiatives have developed their own frameworks, standards, and guidelines for ESG reporting, leading to a lack of uniformity and creating a daunting array of options for companies. Notable frameworks include the European Sustainability Reporting Standard (ESRS), Global Reporting Initiative (GRI), the Sustainability Accounting Standards Board (SASB), the Task Force on Climate-related Financial Disclosures (TCFD), and the Carbon Disclosure Project (CDP), among many others. Each framework has its own unique focus, metrics, and reporting requirements as they seek to establish themselves within sectors and/or markets.

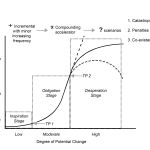

Moreover, the evolving nature of ESG standards and the emergence of new reporting requirements pose some very serious challenges for companies. Regulatory bodies, investors, and stakeholders are demanding more comprehensive and transparent ESG disclosures, and insist on increasingly detailed justifications for the choice of reported indicators. Staying abreast of this shifting landscape is one thing, being on top of how you need to adjust your reporting, datasets and indicators is almost impossible. This dynamic environment further complicates the decision-making process of Boards and management, and adds to the stress and pressure associated with selecting an appropriate methodology.

And to add another layer of complexity, the competitive dynamics within industries contribute to the stress and pressure surrounding ESG reporting. As companies seek to differentiate themselves and gain a competitive edge, the selection of the ‘right’ ESG reporting methodology becomes a strategic imperative. The fear of falling behind industry peers, losing market share, or facing public scrutiny for inadequate ESG reporting further intensifies the pressure on organisational leaders.

Stakeholder Expectations and Investor Influence

The expectations of stakeholders, including investors, customers, employees, and regulators, play a significant role in shaping the stress and pressure surrounding ESG reporting methodologies. Investors, in particular, are increasingly integrating ESG factors into their investment decisions, seeking reliable and standardised ESG data to assess the sustainability performance and risk exposure of companies. As a result, companies face mounting pressure to adopt ESG reporting methodologies that align with investor expectations and industry best practices, but they vary. Investors have significantly different profiles, risk perceptions, data and reporting preferences, and favoured reporting formats.

The potential consequences of failing to meet stakeholder expectations can be severe, affecting a company’s reputation, access to capital, and ability to attract and retain talent. This heightened scrutiny amplifies the stress associated with choosing the right methodology, as companies strive to demonstrate their commitment to sustainability and responsible business practices.

Regulatory Compliance and Legal Implications

The regulatory landscape surrounding ESG reporting is evolving rapidly, with governments around the world introducing new requirements and standards to enhance corporate transparency and accountability. Companies operating in multiple jurisdictions must navigate a complex web of ESG regulations, which often differ in scope, focus, and reporting requirements. The need to ensure compliance with diverse regulatory frameworks adds to the stress and pressure of selecting an appropriate ESG reporting methodology.

Furthermore, the legal implications of ESG reporting errors cannot be overlooked. Inaccurate or misleading ESG disclosures can lead to legal repercussions, including regulatory investigations, fines, and litigation. The fear of inadvertently making a mistake in ESG reporting, which could result in legal liability, amplifies the pressure faced by companies and their decision-makers.

Risk of Reputational Damage and Loss of Trust

The potential for reputational damage and loss of trust looms large for companies grappling with ESG reporting methodologies. Inaccurate or inconsistent ESG disclosures can undermine a company’s credibility and integrity, supressing employee morale, eroding stakeholder trust and negatively impacting its brand image. Given the heightened public awareness of environmental and social issues, any misstep in ESG reporting can quickly become a focal point for media scrutiny and public criticism.

Furthermore, in an age of social media and instant information dissemination, the repercussions of ESG reporting mistakes can be swift and far-reaching. Companies are acutely aware of the lasting impact that reputational damage can have on their relationships with customers, investors, and other stakeholders. This awareness contributes to the stress and pressure associated with ensuring the accuracy and reliability of ESG reporting methodologies.

Financial Risks and Impact on Valuation

Inaccurate or incomplete ESG reporting can pose financial risks for companies, affecting their access to capital and the valuation of their securities. Investors rely on ESG data to assess the long-term sustainability and performance of companies, integrating this information into their investment decision-making process. Consequently, errors in ESG reporting can lead to misinformed investment decisions, potentially impacting a company’s stock price, cost of capital, and overall valuation.

Additionally, as sustainable investing continues to gain momentum, companies that fail to meet ESG reporting expectations may face challenges in attracting investment and may be excluded from ESG-focused investment portfolios. The financial implications of ESG reporting mistakes underscore the magnitude of the pressure faced by companies as they navigate the complex landscape of reporting methodologies.

Furthermore, selecting an inappropriate ESG reporting framework can result in the misalignment of reporting practices with the company’s actual ESG performance. This misalignment not only undermines the credibility of the reported data but also hinders the organization’s ability to effectively manage and improve its ESG impact. As a result, the company may miss out on opportunities to drive positive change, enhance operational efficiency, and mitigate ESG-related risks, ultimately impacting long-term sustainability and competitiveness.

Mitigating Stress and Managing Risks

Given the stress and pressure associated with choosing the right ESG reporting methodology it is surprising how many organisations don’t make more of an effort to identify and monitor both the framework and indicators they use. At the very least, such assessments should be considered a component of a comprehensive risk assessment. This involves evaluating the potential impacts of different methodologies on reporting accuracy, stakeholder expectations, and regulatory compliance. Identifying and understanding potential risks early in the decision-making process allows organizations to make informed choices.

Let’s be clear here, extensive stakeholder engagement is crucial in the ESG reporting process. Companies should actively seek input from stakeholders, including investors, employees, and customers, to understand their expectations and preferences regarding reporting methodologies. Transparent communication about the chosen methodology, the reasons behind the selection, and the company’s commitment to accurate reporting builds trust and aligns with the principles of stakeholder inclusivity.

If in Doubt, Get a Sector Expert

The dynamic nature of ESG reporting requires companies to continuously monitor changes in regulatory requirements, industry best practices, and stakeholder expectations. Adopting an adaptable approach allows organisations to revise their reporting methodologies as needed, ensuring ongoing relevance and alignment with evolving standards. Continuous monitoring also enables companies to proactively address emerging risks and challenges, publicly report them and encourage outreach and collaborations.

But collaboration is not natural for many organisations and benchmarking against peers can be very problematic, even if it can provide valuable insights into best practices and successful ESG reporting approaches. Engaging with sector experts, industry associations, participating in two-way initiatives, and leveraging industry benchmarks can help companies make informed decisions about methodology selection. Learning from the experiences of experts and peers can enhance the effectiveness of ESG reporting strategies.

Assess, Engage, Monitor, Adapt and Advise

Choosing the right methodology for ESG reporting is a decision laden with stress and pressure, given the multifaceted nature of sustainability, the diversity of reporting standards, and the high expectations of stakeholders. The risks associated with making mistakes in this process can have far-reaching consequences, affecting a company’s reputation, regulatory compliance, and overall sustainability efforts. To navigate this complex landscape, organisations must conduct thorough risk assessments, engage stakeholders transparently, monitor changes in the regulatory environment, remain adaptable to evolving industry standards, and reach out to experts on a regular basis. By mitigating risks and making informed decisions, companies can not only enhance the accuracy and credibility of their ESG reporting but also contribute to building a more sustainable and transparent business environment.

Click here for information on how to make your ESFG reporting more meaningful.