ESG Dirty Double Data

In almost every call I have these days the same problem comes up – DATA! “The system is going well but we’re having a problem finding consistent data. The Italian office says they are billed quarterly and it doesn’t contain a usage amount, just a flat rate. The office in Poland is a shared workspace so there is no data at all. The staff have changed in Madrid and they don’t know where the records are kept. And Japan never replies to any of our emails.’

Estimations and approximations are the new game in ESG reporting, and they pose a massive risk to companies. Double materiality adds context and complexity to methodologies and indicators, but it has to have accurate data, and we haven’t got close to the value chain yet!

Data issues lie are the core of ESG reporting and ESG misreporting. Is there a solution?

The Theory is Solid

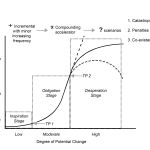

The concept of double materiality in ESG reporting recognises the interconnectedness of sustainability impacts both within the organisation and across its value chain. However, the assessment of double materiality poses challenges, particularly in scenarios where ESG reporting is duplicated or overlaps within the value chain. So, we’ll begin with exploring some scenarios of duplicating ESG reporting, the impact it can have on assessing double materiality, and the broader implications for ESG reporting practices.

Double materiality extends the traditional concept of materiality, which typically focuses on risks and opportunities within the organisation (internal materiality) to embrace the importance of external impacts beyond the organisation’s boundaries, particularly within the broader value chain (external materiality). This dual perspective is crucial for a comprehensive assessment of the organisation’s sustainability performance.

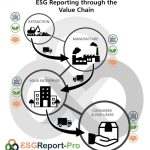

The value chain encompasses all stages of a product or service lifecycle, from raw material extraction to end-of-life disposal. Understanding double materiality requires organisations to assess the environmental, social, and governance impacts not only within their own operations but also throughout the value chain. The complexity of global supply chains and interconnected business relationships makes collecting relevant data and evaluating double materiality very challenging indeed.

Overlapping Reporting Boundaries

One data challenge involves overlapping reporting boundaries within the value chain. Different entities within the value chain may independently report on the same ESG indicators, leading to duplication of efforts and data. For instance, a company and its suppliers may separately report on energy consumption or greenhouse gas emissions, resulting in redundancy and potentially inconsistent information. ‘Who should be reporting what data?’ is the first question you need to address with your value chain.

Inconsistent Measurement Methodologies

Duplications in data may arise from inconsistencies in measurement methodologies used by different entities within the value chain (see Methodology Madness for more). Varied interpretations of ESG metrics, scope definitions, and data collection methods can result in conflicting information. For example, discrepancies in how water usage is measured or reported by different value chain partners can hinder accurate assessments of double materiality. So, the next question is therefore ‘How do we agree to measure data?’.

Lack of Standardisation

The absence of standardised ESG reporting frameworks and guidelines can contribute to duplications in reporting and misinterpretations of data. Without universally accepted standards, companies and their value chain partners may adopt disparate reporting frameworks or customise existing ones to align with their specific preferences or priorities. This diversity in reporting practices can have a range of possible effects from undermining data integrity to complicating the assessment of double materiality. So, the third question for your value chain partners is, ‘How to we agree to report data?’

Fragmented Data Leads to Problems…

This is all lovely assuming data is source-able, traceable and readily available, but it isn’t, and that leads to data fragmentation. Duplications and variations within the value chain lead to an incomplete and patchy picture of sustainability impacts. Stakeholders, especially investors, know that relying on ESG information for decision-making may face challenges in obtaining a holistic view of the organisation’s sustainability performance when data is scattered, inconsistent, or duplicated. This fragmentation creates dirty data and hinders the accurate assessment of double materiality and an organisation’s performance.

A serious and major concern is in identifying ESG hotspots—areas of significant environmental or social impact—which becomes challenging when reporting is duplicated within the value chain. Inconsistent or redundant data may obscure the identification of critical areas requiring attention or improvement. Understanding the true extent of impact becomes complex when multiple entities report on the same indicators using different methodologies or scopes.

…And Problems Lead to ESG Fatigue

Duplications in ESG reporting can therefore erode stakeholder trust, even from the value chain partners who have helped to collect the data! When stakeholders encounter inconsistencies or redundancies in reported data, they may question the transparency and reliability of the organisation’s sustainability disclosures. Impaired trust can have far-reaching consequences, affecting relationships with investors, customers, employees, and regulatory bodies, and undermining the organisation’s credibility in its commitment to sustainability. Boards and senior management discuss the problem – is it a compliance issue? A due diligence process? Do we need new contracts? Maybe there are some sector figures we could use? There isn’t a single solution but where to start?

The data collection process is reviewed, value chain partners go through the whole process again in an attempt to overcome data fragmentation. Companies and suppliers may find themselves reporting on similar ESG indicators multiple times, leading to a redundant use of resources and increased administrative burden. Everyone is beginning to get tired of the process, which really should be focusing on implementing transition plans and finding solutions… it’s all beginning to feel like a lost opportunity. Reporting fatigue is setting in and the willingness of organisations to actively engage in ESG reporting is reducing, which in turn hinders the collective effort and leads to more fragmentation and inaccuracy.

But Don’t Standards Fix That?

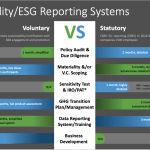

Yes and no. Globally accepted standards for ESG reporting, such as those provided by organisations like the EU through the Corporate Sustainability Reporting Directive (CSRD), Global Reporting Initiative (GRI) and Sustainability Accounting Standards Board (SASB), promote consistency and reduce redundancies within the value chain. Standardised frameworks facilitate more accurate assessments of double materiality but they don’t solve the problem of missing data, potential double counting and data fragmentation.

What About Enhanced Collaborations?

Are a good start. Enhancing collaboration and coordination among entities within the value chain can help minimise duplications in reporting. Value chain partners can work together to establish common reporting methodologies, share data, and align their sustainability priorities. Collaborative initiatives, industry alliances, and partnerships facilitate a unified approach to ESG reporting, reducing redundancies and ensuring a more cohesive assessment of double materiality. This is all really good stuff, but it takes time, is often given a low priority compared to day-to-day internal operational issues and doesn’t fully address the problems as transparency is limited between entities. Organisations should proactively communicate their commitment to minimising redundancies, explain reporting methodologies, and seek stakeholder input on ways to improve reporting efficiency. Transparent communication fosters trust and aligns stakeholders with the organisation’s sustainability goals.

Technology and Data Integration Wins

Leveraging technology through software like ESG Report Pro for data integration throughout your value chain provides a framework for collaborations, agreement on standards and drives data sourcing and integrity. Dispersed, integrated software can streamline ESG reporting processes and reduce duplications. Implementing dispersed integrated systems allows seamless data exchange, and reporting across the value chain enhances efficiency. Technologies such as machine learning, data-sharing platforms, and cloud-based solutions can promote real-time data accessibility, accuracy, and consistency in ESG reporting – that’s why we made ESG Report Pro!

In Conclusion

Dirty double data within the value chain poses challenges to the accurate assessment of double materiality, hindering stakeholders’ ability to obtain a comprehensive understanding of sustainability impacts. Overlapping reporting boundaries, inconsistent measurement methodologies, and a lack of standardisation contribute to this complexity. The impact of duplications includes an incomplete picture of sustainability performance, difficulty in identifying hotspots, impaired stakeholder trust, and increased reporting fatigue. Addressing dirty double data requires a concerted effort from organisations, value chain partners, and industry stakeholders.

Dispersed, integrated software, like ESG Report Pro, standardises reporting frameworks, fosters collaboration, leverages technology, promotes transparency and is crucial to minimizing redundancies and enhancing the accuracy of ESG reporting. By addressing the challenges associated with inaccuracies, organisations can contribute to a more transparent, efficient, and effective assessment of double materiality, reinforcing their commitment to sustainable and responsible business practices.