ESG - The Basics

IS THERE ANY FLEXIBILITY?

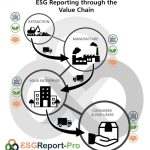

Your Value Chain is probably huge, so is there any flexibility or quick assessments with all this analysis?

My Value Chain is HUGE, where do I even begin to assess it?

First, let’s reassure you, companies are not expected to go supplier by supplier, component by component, up- and down-streams in an exhaustive effort to find all possible impacts, risks and opportunities, and then organise every one into a double materiality matrix! The ESRS does recognise that there is a limit to resources, contractual arrangements, levels of control and buying power. Plus, they have added some Phase-Ins and possible exclusions in some circumstances. However, there is work to do, so let’s try to simplify it as much as possible.

Where to Begin with Value Chain Double Materiality.

It’s best to begin by looking at the Value Chain in entirety, take a backstep from it, and determine where risks and opportunities can be most material, both in terms of impacts and financials – see The What and How of Double Materiality For more information.

The primary considerations should address geographical areas, facilities or types of assets, inputs, outputs and distribution channels by documenting an overview that identifies, assesses and prioritises your organisation’s potential and actual impacts on people and the environment.

Review Information Gathered as Due Diligence

Most commonly this information is gathered through your due diligence process, including whether and how your organisation:

- Identifies in your business model, strategy and decision-making (including own operations and up- and downstream value chain) where material impacts, risks and opportunities are concentrated.

- Has responded or plans to respond to these effects, including timelines and any changes it has made or plans to make to its strategy or business model as part of its actions to address particular material impacts or risks, or to pursue particular material opportunities.

- Focuses on specific issues due to heightened risk of adverse impacts and then considers the impacts with which the undertaking is involved through its own operations or as a result of its business relationships (both up and down the Value Chain).

- Prioritises negative impacts based on their relative severity and likelihood.

The ESRS expects the assessment process to include information from industry group publications, investor publications and engagement activities, civil society and media reports, Business and Human Rights Resource Centre, data on where incidences most frequently arise for certain sectors; and both government-issued and independent publications on country-level human rights and environmental risks.

It is also important to keep in mind that this a dynamic process, requiring reassessment each year to better define material impacts, risks and opportunities along the value chain, as well as scanning for other high-risk areas.

DETAILED GUIDES

We hear you cry 'It's REALLY hard to find the information?'

Is There Any FLEXIBILITY?

Yes, because this is expected to be a problem for organisations for some time. There is some flexibility for the first 3 years in the event that not all necessary information regarding your upstream and downstream value chain is available. For missing or incomplete reporting, the organisation must explain the efforts made to obtain the necessary information and the reasons why it could not be obtained, as well as plans to obtain the necessary information in the future.

The EU Expects Problems in These Circumstances

It is wise to anticipate that you may face difficulties with value chain reporting and do the following:

- When disclosing information on policies, actions and targets you may limit upstream and downstream value chain information to information available in-house, such as data already available to the undertaking and publicly available information; and

- When disclosing metrics, it is not required to include upstream and downstream value chain information, except for datapoints concerning specific governance and organisational reporting requirements.

PHASE-IN Criteria May Also Apply

Additionally, there are some Phase-In criteria that may mean your organisation may omit elements of the ESRS reporting, for example:

- Undertakings with less than 750 employees may omit scope 3 GHG emissions data and the disclosure requirements specified in ‘own workforce’ in the first year that they apply the standards;

- Undertakings with less than 750 employees may omit the disclosure requirements specified in biodiversity and on value-chain workers, affected communities, and consumers and end-users in the first two years that they apply the standards.

- All undertakings may omit the following information in the first year that they apply the standards: anticipated financial effects related to non-climate environmental issues (pollution, water, biodiversity, and resource use); and certain datapoints related to their own workforce (social protection, persons with disabilities, work-related ill-health, and work-life balance).

- Voluntary disclosures: biodiversity transition plans; certain indicators about “non-employees” (self-employed persons or persons provided by workplace agencies or similar); and an explanation of why the undertaking may consider a particular sustainability topic not to be material.

- Flexibilities in specific disclosures: for example, there are additional flexibilities in the disclosure requirements on the financial effects arising from sustainability risks and on engagement with stakeholders, and in the methodology to use for the materiality assessment process. Furthermore, the datapoints regarding corruption and bribery and regarding the protection of whistle-blowers have limited flexibility regarding what might be considered to have infringed on the right not to self-incriminate.

And if you still cannot find accurate information from your value chain? Firstly, describe how you have made every attempt to do so and then you may make estimations using all reasonable and supportable information that is available at the reporting date without undue cost or effort. This includes, but is not limited to, internal and external information, such as data from indirect sources, sector- average data, sample analyses, market and peer groups data, other proxies or spend-based data.

Finally, it is worth noting that the European Commission is putting in place an interpretation mechanism to provide formal interpretation of the standards. The Commission has also asked the European Financial Reporting Advisory Group (EFRAG) to publish additional guidance and educational material, addressing the materiality assessment process and other issues.