ESG - THE BASICS

WHERE TO BEGIN, WHAT TO DO, HOW TO DO IT?

What is ESG and Why is it important? Let’s cover the jargon in our glossary of terms and then we can cover the new ESG rules in Europe and around the world… oh, and what is the CSDDD?

Let’s introduce you to ‘ESG 101’ – the whats, hows and whys of ESG reporting in Europe and around the world.

So, what is ESG?

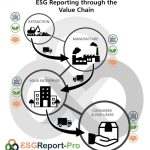

ESG is a framework that assesses a company’s performance and impact in three areas: Environmental, Social, and Governance. Environmental criteria consider a company’s efforts in climate change, pollution, water use, biodiversity and commitment to developing a circular economy. Social criteria focus on how a company manages relationships with its employees, workers in their supply chain, customers, communities, and other stakeholders. Governance criteria evaluate the company’s leadership, transparency, and ethical practices.

WHY IS ESG IMPORTANT?

ESG is important for several reasons

Identify and Manage Risks and Opportunities

First, it helps identify and manage risks and opportunities associated with environmental and social issues, such as climate change, biodiversity, water, pollution, product end of life management, labour practices, and human rights. By addressing these risks and opportunities, companies can enhance their long-term sustainability and avoid potential legal, reputation and financial consequences.

Considered by Investors, Lenders and New Staff

Second, ESG factors are increasingly considered by investors, lenders, potential new staff and other stakeholders when making decisions. Demonstrating a commitment to ESG can attract capital and talent, improve access to funding, and enhance a company's valuation and reputation.

Aligns with Growing Societal Expectations

Third, ESG aligns with growing societal expectations. Consumers, employees, and communities are increasingly concerned about environmental and social issues, and they favour companies that prioritise sustainability, diversity, and responsible practices. By embracing ESG, companies can foster trust, loyalty, and positive relationships with their stakeholders.

In summary, ESG is a comprehensive framework that helps companies manage risks, identify new opportunities, attract capital, and align with societal expectations. By integrating ESG principles into their strategies and operations, companies can enhance their long-term success and contribute to a more sustainable and equitable future.

ESG GLOSSARY

Glossary of key ESG terms and definitions, including NFRD vs CSRD vs ESRS?

These are just a few key terms in the vast field of Environmental, Social and Governance (ESG) landscape, which is continuously evolving and new terms and concepts may emerge over time.

Environmental:

- Carbon footprint: The amount of greenhouse gas emissions, particularly carbon dioxide, produced by an individual, organization, or activity.

- Carbon credit: A carbon credit is a tradeable certificate that constitutes an offset of 1 ton of carbon dioxide or carbon dioxide equivalent from the atmosphere.

- Carbon emission: The release of carbon dioxide or equivalent greenhouse gas into the atmosphere.

- Carbon tax: A government issued environmental tax or penalty that organisations have to pay for production of greenhouse gases.

- Carbon dioxide equivalent (CO2e): A global warming potential (GWP) metric used to quality the combined emissions of all greenhouse gases from an activity.

- Renewable energy: Energy derived from sources that are naturally replenished, such as solar, wind, or hydro power.

- Biodiversity: The variety of plant and animal species within a given ecosystem.

- See “Explained – Carbon management, offsetting, carbon reduction and carbon footprint” for more details.

- See also “What to say and what not to say about carbon?

Social:

- Diversity Equity and Inclusion (DEI): The practice of embracing and valuing individuals from different backgrounds, cultures, and identities, and ensuring equal opportunities for all.

- Human rights: Fundamental rights and freedoms that every individual is entitled to, such as the right to life, liberty, and security.

- Labour standards: Guidelines and regulations that protect workers’ rights, including fair wages, safe working conditions, and freedom of association.

Governance:

- Board diversity: The representation of individuals from diverse backgrounds, experiences, and perspectives on a company’s board of directors.

- Executive compensation: The financial rewards and benefits given to top executives within a company, typically including salary, bonuses, and stock options.

- Transparency: The degree to which a company provides open, accurate, and accessible information about its operations, financial performance, and decision-making processes.

ESG Integration:

- ESG integration: The process of incorporating ESG factors into investment analysis and decision-making to better understand the risks and opportunities associated with an investment.

- Materiality: The significance or importance of an ESG issue to a particular company or industry, based on its potential impact on financial performance and stakeholder interests.

- Double Materiality: The significance or importance of an ESG issue to a particular company or industry, based on its potential impact on financial performance and stakeholder interests as well as operational performance and impacts on the world at large.

- Stakeholder Engagement: The practice of actively involving and communicating with stakeholders, such as employees, customers, communities, and investors, to understand their concerns and interests.

ESG Standards:

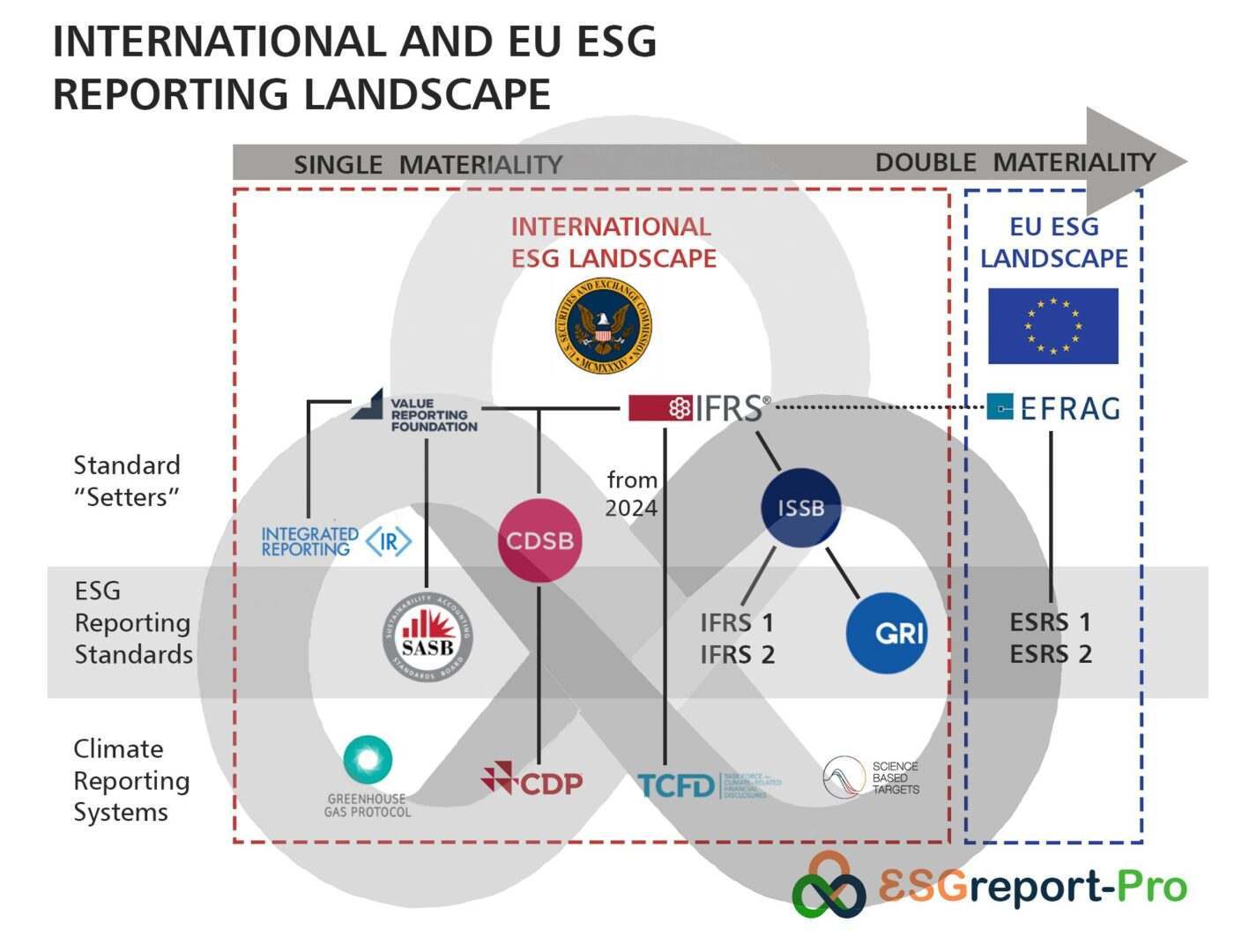

- CSRD: the Corporate Sustainability Reporting Directive, came into force from 5 January 2023, updating the NFRD and applicable to a broader set of companies, as well as listed SMEs.

- ESRS: the European Sustainability Reporting System is a key provision of the CSRD and came into effect in July 2023. Covering 5 environmental, 4 social and broad governance reporting areas the ESRS is a comprehensive statutory ESG reporting system.

- TCFD: the Taskforce of Climate-based Financial Disclosures, (including TNFD, the Taskforce of Nature-based Financial Disclosures) established 2015 by the Financial Stability Board at the request of the G20 Finance Ministers and Central Bank Governors.

- NFRD: the Non-Financial Reporting Directive required companies to publish a non-financial report on their ESG performance together with their annual management report. It is now replaced by the CSRD.

- IFRS: the International Financial Reporting Standards and replaced the International Accounting Standards (IAS) in 2001. The IFRS 1 and IFRS 2 are both consistent with the ESRS from a financial materiality perspective.

- ISSB: the International Sustainability Standards Board, established 2021 by the IFRS Foundation, formerly consolidating CDSB (Climate Disclosure Standards Board) and VRF (Value Reporting Foundation).

- GRI: the Global Reporting Initiative, established 1997 in Boston (MA) with roots in the non-profit CERES and Tellus Institute. The GRI is consistent with the ESRS from a general reporting perspective.

For more terms and explanations see: https://climatepromise.undp.org/news-and-stories/climate-dictionary-everyday-guide-climate-change

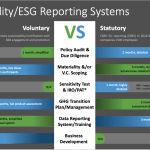

The International and European ESG Reporting Landscape

The ESG reporting organsations landscape is a serious maze and it keeps changing. So here’s a diagram of the landscape as at September 2023.

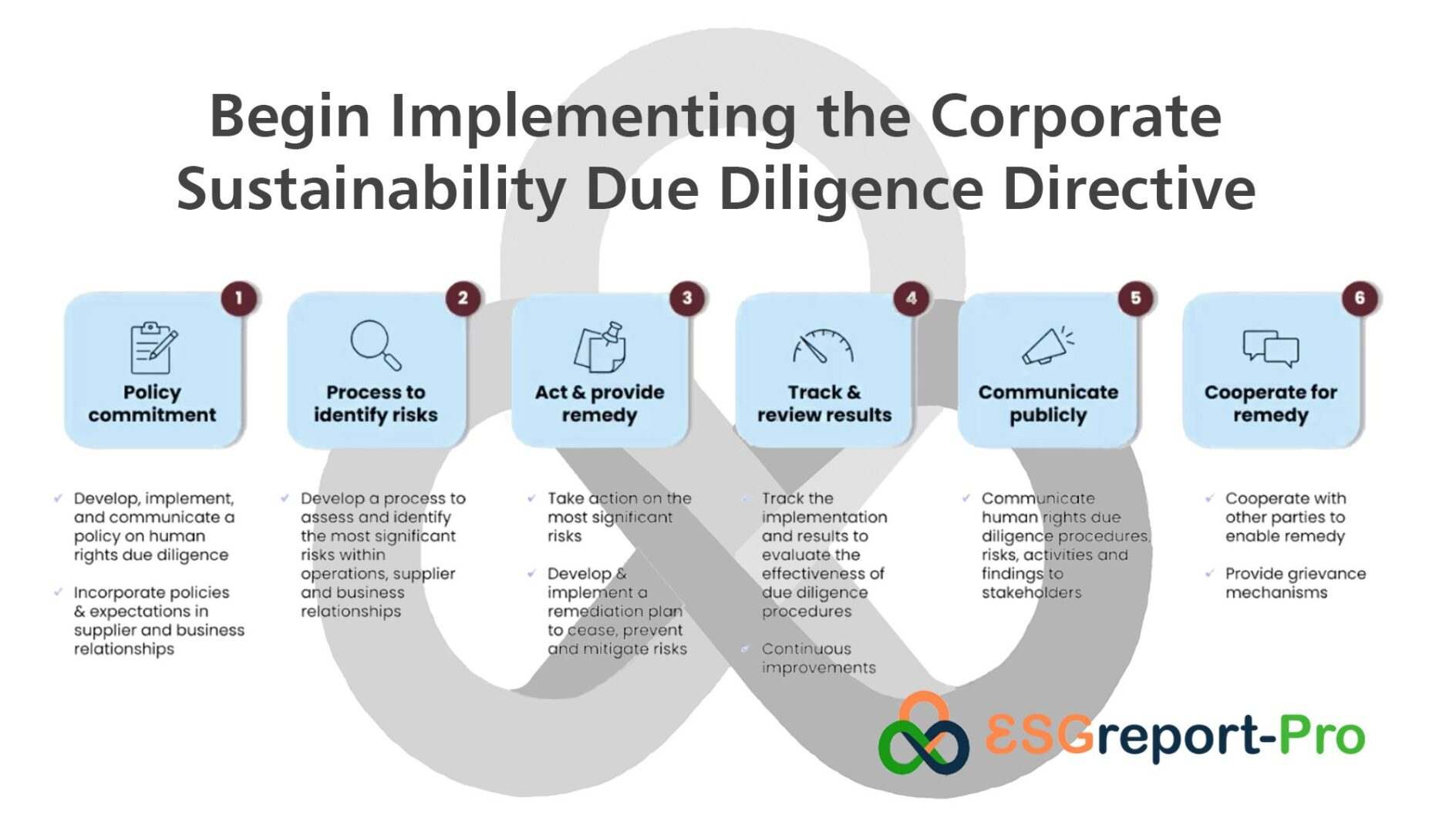

COMING SOON TO EUROPE - THE CSDDD!

The Corporate Sustainability Due Diligence Directive is coming in 2024 and it applies to every company in some form. We still don’t have full details, but this is what we do know right now:

STEP 1: Policy Commitment

Develop, implement and communicate a policy on human rights due diligence. Incorporate your policy(s) and expectations in supplier and business relationships.

STEP 2: Process to Identify Risks

Develop a process to assess and identify the most significant risks within operators, suppliers and business relationships.

STEP 3: Act and Provide Remedy

Take action on the most significant risks. Develop and implement a remediation plan to cease, prevent and mitigate risks.

STEP 4: Track and Review Results

Track the implementation and results to evaluate the effectiveness of your due diligence processes. Implement continuous improvement and review process.

STEP 5: Communicate Publicly

Communicate human rights due diligence procedures, risks, activities and findings to stakeholders.

STEP 6: Cooperate for Remedy

Cooperate with other parties to enable remedy. Provide and promulgate grievance mechanisms.

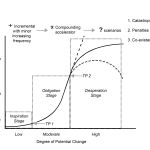

Prior Planning is the Basis of Successful Performance

And Performance Leads To Success!

We're here to help you produce timely and accurate ESG reports, but we'd like to see all our clients achieving more than that.