ESG - THE BASICS

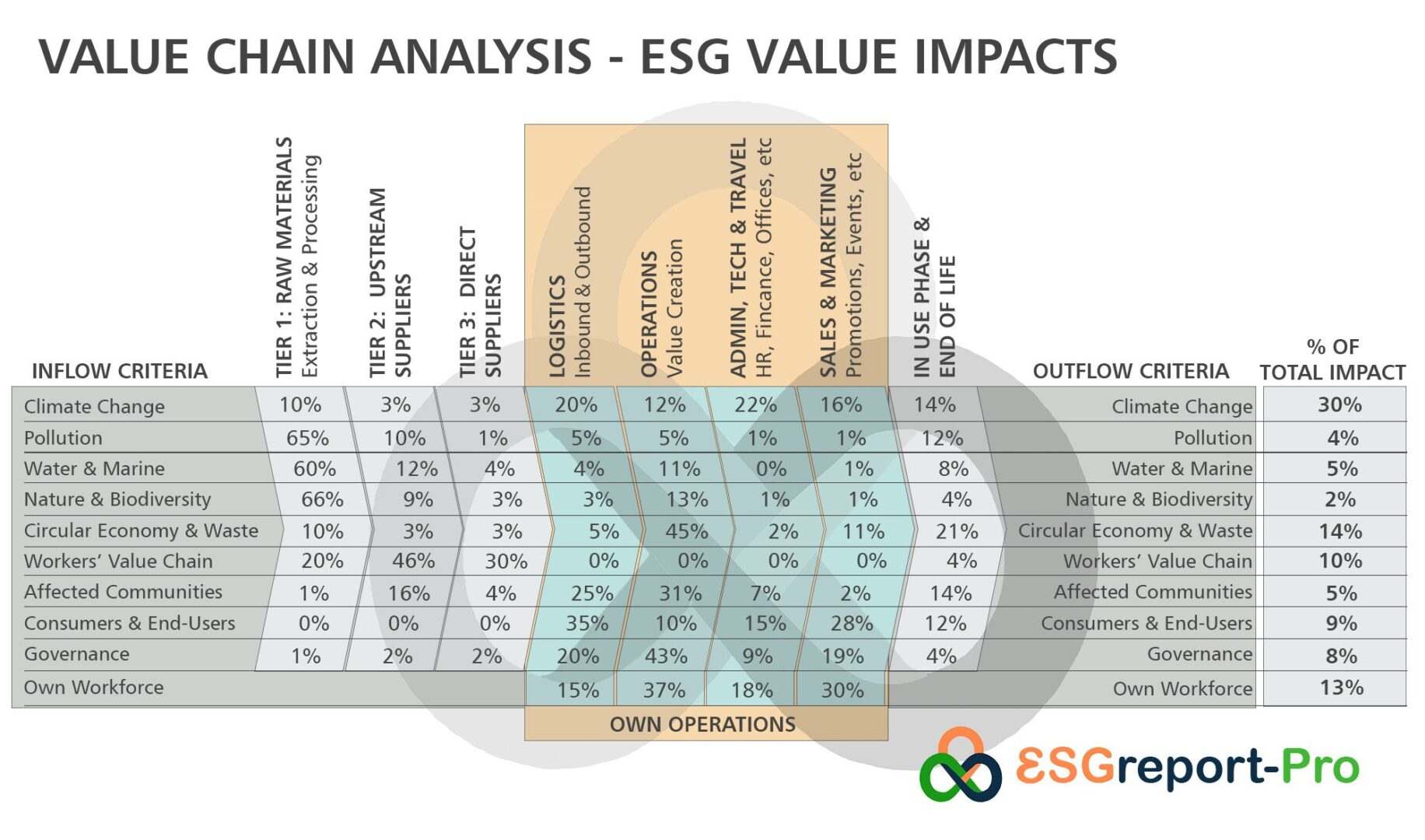

Value Chain Analysis and ESG Value

Let’s begin with a simple assessment of your value chain and describing ESG value and impacts, then we can move on to deciding what and who to include.

Add ESG value to your business partners

Embed ESG Reporting Through Your Value Chain

Embedding ESG reporting in your value chains partners helps them and you to help you deliver the best value possible to your customers. Plus your partners can produce their own ESG reports!

With 150+ criteria aligned to international methodologies and calculation tools, ESG Report Pro gives you all the information you need to develop a better, stronger and more resilient business.

Make Data Gathering Easier and more Accurate

ESG Report Pro is modular so you can choose which of the Environment, Social and Governance indicators to distribute through your value chain.

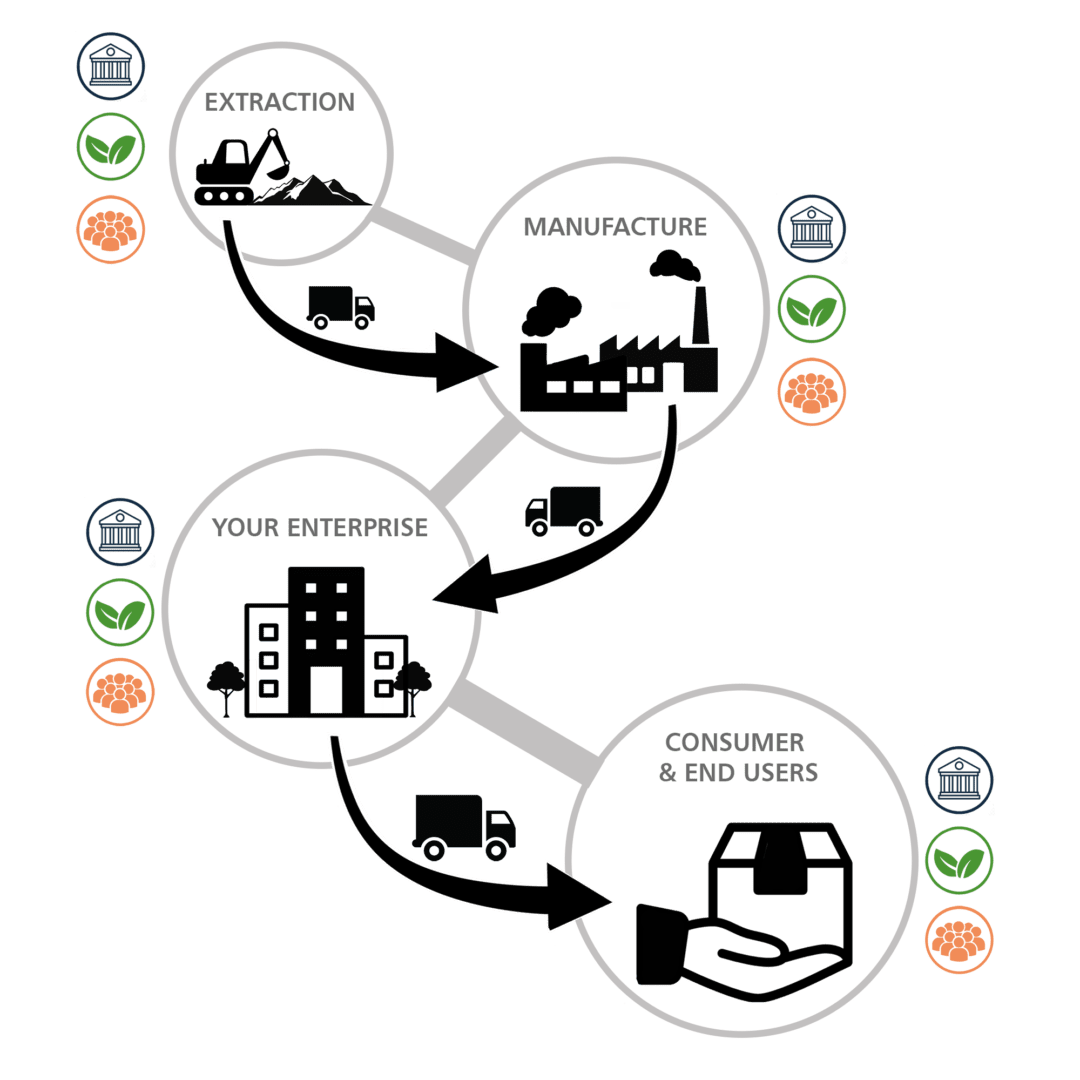

Value Chain Analysis (VCA)

A Value Chain Analysis provides a clear picture of every step in your workflow and business processes, from the first extraction of materials to end of life processing. As a result of identifying and describing each step in your Value Chain, you are then able to Map them, which gives you ideas for areas of improvement, including how to gain a competitive advantage and increase profits. In 1985, Michael E. Porter (Competitive Advantage: Creating and Sustaining Superior Performance, Free Press, 1985) proposed that profits are directly related to your Value Chain:

Profit Margin = Value Created – Cost of Value Creation

Cost vs Differentiation

In reality, value creation combines both approaches and extends from initial material extraction or formation, through to the end of the product or service lifetime. However, it is generally true that physical product manufacturers tend to focus more on Cost Advantage Value and service-based businesses focus on Differentiated Value (features, customisation, additional services, etc).

Dig Into Value Creation

So, the greater you can create value (usually by differentiating your product or service) and/or reduce your costs of value creation, the more profits you can make. However, to understand Value Chain Analysis you must dig into what and how you, your suppliers and your customers create value. Value Chain theory suggests that there are two approaches to assessing value – through costs advantages and through differentiation (value created).

Introducing ESG Value

When thinking about a Value Chain from an ESG reporting perspective there needs to be additional criteria to both Cost Advantage and Differentiation – how are they sustainable and could they be more sustainable? There is often a trade-off between cost and differentiation, each business will find their own balance between them, and the principles of ESG Value are an excellent vehicle for assessment and organisational growth

ITS TIME TO INCLUDE ESG ``Benefit Returns – ESG Impact Mitigation/Adaptation``

ESG generates benefits, impacts, risks and opportunities through your value chain. It's time to recognise them and incorporate them into our way of doing business.

We’ve reinterpreted Porter’s theory through an ESG lens. The result is surprisingly simple and forms a bridge between Cost Advantage and Differentiation models.

Cost Advantage Value

This approach is about competing on cost and involves cutting production costs and streamlining processes to increase profitability. For example, if your company develops apps, you can gain cost advantage by cutting contracting costs.

ESG Value

For each cost and differentiation identify the greater and lesser sustainable approach – these often have a trade-off balance which can be used to outline a product/service development pathway and/or align with your transition pathway goals. Incorporating ESG Value into your Value Chain Analysis links your Business Strategy, Risk and Opportunity Assessment, and metrics and target setting in your ESG Reporting.

Differentiated Value

This involves adding value by offering a unique or high-quality product or service that sets you apart from your competition. For example, offering added features or superior customer service.

Value Identification Process

- Step 1. Identify the firm’s primary and support activities, including suppliers and customers.

- Step 2. Establish the relative importance of each activity in the total cost of the product.

- Step 3. Identify cost drivers for each activity.

- Step 4. Identify linkages between activities.

- Step 5. Identify opportunities for reducing costs through efficiencies or pricing.

Value Identification Process

- Step 1. Identify material impacts from all stakeholder perspectives.

- Step 2. Evaluate scope and extent of impacts and their role in value creation, including cost/benefit analysis.

- Step 3. Assess impact drivers, their risks and opportunities and, if necessary, review business model and/or market strategy.

- Step 4. Identify USP pathways associated with impact mitigation or product/service adaptation through the value chain.

Value Identification Process

- Step 1. Identify the customers’ value-creating activities, including suppliers and customers.

- Step 2. Evaluate the differentiation strategies for improving customer value, including the value generated through each feature and/or benefit.

- Step 3. Identify the best combination of differentiated features/benefits.

So Porter’s definition of derived Profit Margin now becomes:

Profit Margin = Value Created + ESG Benefit Returns – ESG Impact Mitigation/Adaptation – Cost of Value Creation

When looking into your own business and those of your suppliers and customers, consider all functional areas as they can be a value-source:

- Inbound/outbound logistics: Any activity involved in gaining resources or distributing the product, including receiving, storing/stocking and distributing goods and services.

- Operations: Anything that falls under the banner of producing the product or service, including machinery costs, product assembly and packaging.

- Sales and Marketing: Activities that include awareness raising, promotions, advertising, sales and marketing.

- Service: From customer support to your finance team, service covers anything that’s required to maintain quality control and quality assurance and support the customer during and after a sale.

- Research and development/technology development: Any budget that’s been allocated to innovative activities such as developing and enhancing new and existing products and services.

- Procurement: How any materials that allow a company to undertake its primary activities are sourced, such as specialist/consulting skills, raw materials, office supplies and machinery.

- Human resource management: All processes and systems relating to managing the people in your organisation, such as recruiting, training and retention.

- Infrastructure: Your infrastructure is the operational aspect of your business. For example, company departments like finance, planning, IT and legal.

Mapping your Value Chain allows you to also link to ESG reporting criteria, for example, the Climate Change indicators Scope 1, Scope 2 and Scope 3 emissions.

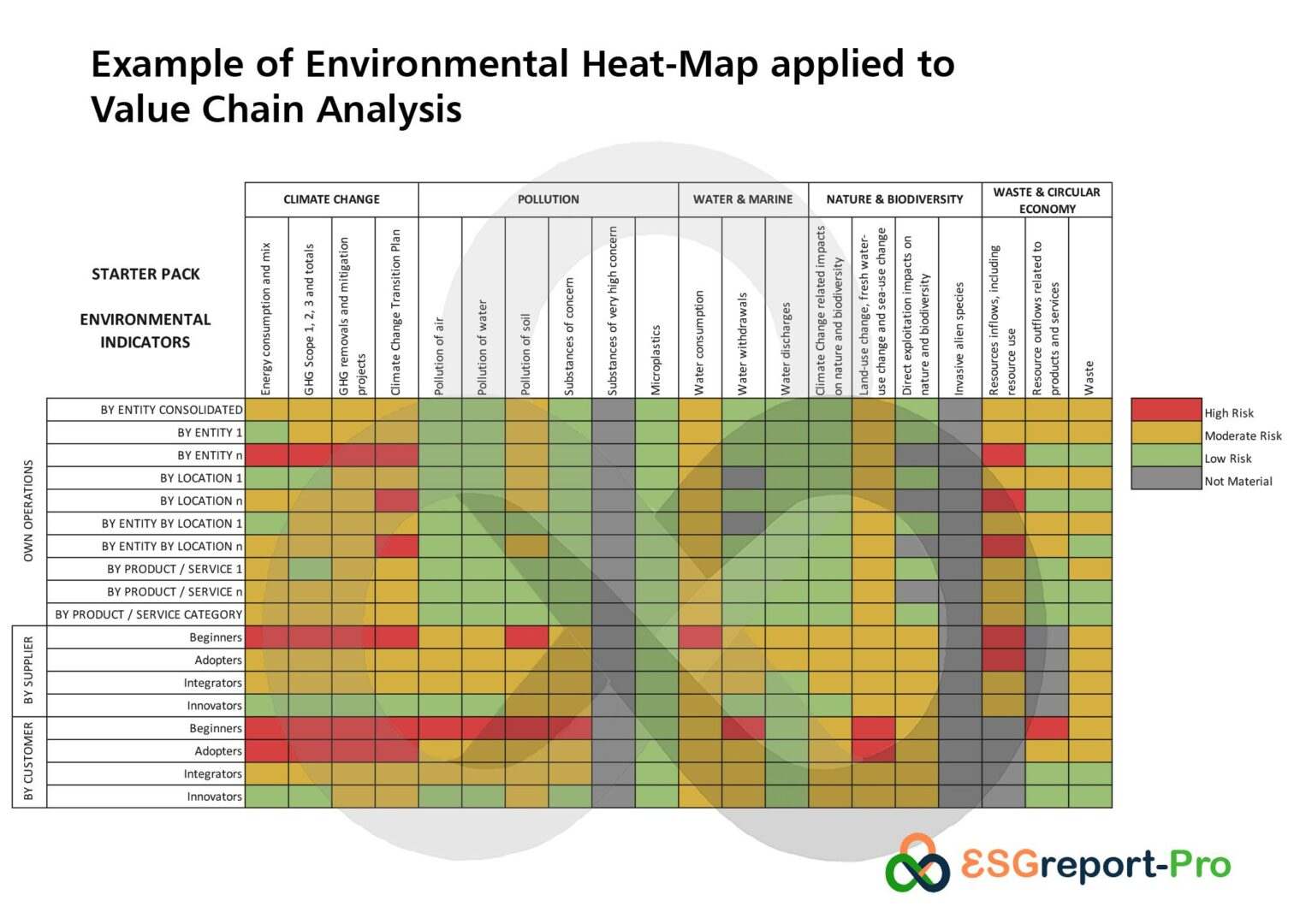

Then Map your value chain using a heat-map that highlights Cost, Differentiation and ESG Value strengths and weaknesses in your suppliers, customers and own operations.

Such insights are core to developing a clear understanding of your Competitive Advantage compared to competitors and how to attract new customers through more effective sales pitches and relevant product development. They also clearly indicate areas of concern in your Value Chain that, if remedied could become a source of competitive advantage.

Get your sales and marketing team to create customer focus groups to prioritise features and benefits from Cost, Differentiated and ESG Value perspectives and do this exercise on your major competitors to better understand your marketplace dynamics and begin benchmarking processes and performance.