Sustainability reporting isn’t light. It costs time and money, and although there are benefits, it’s unlikely that becoming a Certified company will be cost neutral. And now we have statutory reporting to deal with as well – is this the end for voluntary sustainability reporting? Is there a way to navigate a win-win without busting budgets?

The Resource Dilemma: Voluntary vs Statutory in 5 Questions

Let’s take a dive into a big decision – Voluntary vs Statutory – what’s the rub and how can your organisation come out with the best of both worlds?

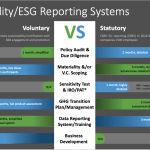

I’m going to put a bunch of sustainability reporting products into the same bucket – B-Corp, GSTC, VSS, GRI, FairTrade, ISO, SASB, TCFD, TNFD, ISSB and IFRS – and call them voluntary standards (there are many more that can be added but the list is not the point here). Some are highly sector specific and others are general. Some have been around for decades and others are relatively new. What is important, is that they are not statutory. It’s a choice to engage with them, and many companies choose not to.

Then we have statutory standards, and this group is dominated by new entrants, most notably the CSRD/ESRS, SFRD and the SEC. But more are coming and the need to fulfil them is causing quite a bit of concern, even panic, around the world. How much will they cost and can you even do it? If you are already part of a voluntary reporting program, what is the extra cost? Is this the end of the voluntary program that you have worked so hard on?

Size Matters

If your organisation has more than 500 employees and is based in Europe, then you must comply with the CSRD/ESRS from this year. There are a couple of other qualifying criteria to check as well but if you had to report under the (now defunct) NFRD, you have to fulfil the CSRD. By 2025-26, the number of staff limit is expected to decrease to 250 and/or €40M+ net turnover and/or € 20M+ in assets. Statutory reporting is here to stay and it will gradually expand to include as many companies as possible.

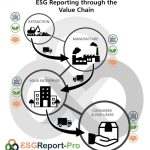

But here’s the first rub. Even if you don’t qualify as a reporting entity in your own right, you are probably doing business with someone who does, and that catches you as part of their value chain. Reporting companies must consider upstream and downstream impacts, including issues like workers’ rights and waste management. No wonder it’s causing some panic!

For now, let’s assume that you have less than 500 employees and you are asking yourself one of these two questions:

- We are likely to have to report in the next year or two as we have 250 staff, so it makes sense to start preparing now but what’s the best lead-in?

- We’ve put a load of effort into a voluntary program but now we’re afraid we’re going to lose all that work, is there a way to do both?

Of course, there is a third question, ‘How deep is the hole I have to stick my head in to ignore ESG reporting?’ but let’s not go there.

Question 1: Flexibility vs. Compliance

The first decision is critical as it will set the tone for all subsequent questions, ‘Looking across your entire organisation, what is the required scope and detail of your policies and extent of your due diligence?’ If you answer to either of those issues, ‘Yes, I think this is going to get complicated’ then statutory reporting should be your focus to start with. Statutory reporting mandates compliance with specific regulations, limiting flexibility but ensuring adherence to a standardised set of reporting requirements. So, the more complicated your organisation, the less likely a voluntary reporting system is going to provide a more competitive cost-benefit outcome at the outset. Answering this question should probably involve a consultant who has an idea of the range of challenges you may face in various sectors (yes, that’s a pitch).

If your answer is along the lines of, ‘Our business units are aligned around a few core competencies that drive market access and/or specific product/service deliverables’ then you have options on the table. This is because your policy and due diligence landscape is quite narrow and voluntary reporting is applicable in this context. Voluntary reporting can offer flexibility in choosing reporting frameworks and indicators aligned with the organisation’s specific sustainability goals.

Question 2: Stakeholder Engagement

Now we come to one of the really big deciding factors – the extent of your value chain and associated level of stakeholder engagement required. Voluntary reporting allows organisations to engage with stakeholders to determine material ESG issues and reporting priorities. However, most voluntary standards are ‘single materiality’ (normally from a financial impact perspective) meaning that they may not fully capture all stakeholder concerns or industry-specific nuances. However, I should mention that as these are voluntary standards, there is no reason why you cannot take a ‘double materiality’ approach and include physical impacts – just about any reporting system will embrace that idea.

On the other hand, statutory reporting demands double materiality from the start and this causes more organisational stress than anything else. Approaching your value chain for information that many will feel is sensitive and/or a waste of time and energy is not easy and will require extensive rapport-building.

To help guide you ask yourself, ‘Can I easily identify a member of senior management in 80% of my value chain partners?’ If you can say yes, then you have a tightly knit chain and access to data will be much easier than if you say no. If you do say no, then a voluntary reporting approach will help you build those relationships through information sharing.

Question 3: Granularity and Detailing

Now there are a group of considerations that are largely interrelated but are treated in different ways by voluntary reporting systems: Transparency, Credibility, Data Quality, Assurance, Risk Management and Legal Compliance.

I mentioned before that your value chain partners might not buy in to your sustainability approach and you will need to make a serious effort to convince them. One of the first hurdles is overcoming transparency-reticence by showcasing credibility. It’s the old carrot and stick approach but it works if done sensitively. Remember that there are more things that you need than just transparency – ensuring data quality and consistency are vital in both voluntary and statutory systems as both will require some sort of assurance, probably by auditors. Assurance then raises some sticky questions about risk (and opportunity) management as well as our legal friends demanding compliance measures… all of which are deeper and more serious in statutory systems.

So how to differentiate here? I think the best approach is to look outwards at your competitors and the broader sector-approach, ‘To what extent is data reporting granularity the standard in your industry?’ For example, sectors with high adoption of ISO standards will always tend towards statutory reporting as the norm.

On a final note, whether you are tending towards voluntary or statutory reporting, you should take your GHG transition planning very seriously, possibly adding an additional voluntary reporting standard to enhance credibility. For any company operating in or near nature, also add the TCFD or similar for the same reason.

Question 4: Support Required

I began this article by saying that sustainability reporting isn’t light. It is a cost and time burden because humans are still prepared to stick their heads in the sand to avoid dealing with the consequences of their actions. Voluntary reporting frameworks know that and have developed a variety of tools to help you encourage and cajole your staff and value chain into positive action. Statutory reporting system don’t care as they impose additional compliance costs and make you jump through a lot of hoops. So, if you think your organisation could do with some hand-holding at times, or would like access to sector-specific skills and resources, then voluntary reporting is probably a good idea.

There is also a related question here about your long-term strategy. Voluntary reporting can support the integration of sustainability into the organisation’s core strategy, fostering a culture of continuous improvement and innovation. Whereas, statutory reporting tends to focus on providing a structured framework for measuring progress towards sustainability goals, aligning reporting with long-term strategic objectives.

To help navigate question 4 ask yourself, ‘How do we expect to be improving our sustainable business in 5-years; through internal innovations or by external regulation?’ The internal innovator will have the market advantage, but the external regulation approach will probably have a cost advantage.

Question 5: Business Development

Perhaps unsurprisingly we have come down to strategy and business development – the source of your competitive advantage and market positioning. Over the last twenty years we have seen early adopters embrace voluntary reporting as a way to differentiate their organisations, attracting socially responsible investors, and enhancing brand reputations. But statutory reporting might rain on their parade as a commitment to sustainability becomes compulsory thus rippling through market positioning and investor perceptions.

One of the strengths of voluntary reporting systems is their flexibility across international operations and jurisdictions. Harmonising reporting practices can streamline processes and enhance consistency in ESG disclosures, facilitating global stakeholder engagement and compliance. If you do not have a large amount of leverage within your value chain, then voluntary reporting might be the only viable option to begin. In such a situation you might also need some extra time to see how regulations evolve and if any trends emerge within your sector(s). So, our question here is, ‘To what extent can we influence our value chain towards sustainability and if not, could we consider a low-cost market position rather than a differentiated position?’ There is a balancing act between voluntary and statutory reporting which can help organisations adapt to changing expectations, address emerging ESG issues, and stay ahead of regulatory developments. Or it could sink them.

I can only ask that you carefully consider each of the above questions to identify your issues and then make informed decisions between voluntary sustainability reporting and statutory sustainability reporting standards. Aligning your operational practices with sustainability goals, stakeholder expectations, and regulatory obligations is very likely to become the key core competence of the future. Good luck and please reach out if you have questions.