ESG - The Basics

THE WHAT AND HOW OF DOUBLE MATERIALITY

It sounds scary, but actually its common sense… to fully understand your value chain you must consider financial and material impacts, and that's Double Materiality.

What is Double Materiality?

Let’s first be clear, no organisation is required to disclose classified information or sensitive information, even if it is considered material, so you do not have to disclose and trade secrets or the like.

OK, so what do you have to disclose? Double materiality has two dimensions that are inter-related, namely: financial materiality and impact materiality.

Financial Materiality

This aspect should be familiar to you and focuses on identifying ESG issues that are financially material to the organisation in that they create or erode enterprise value. For example, they are issues that could affect the company’s financial condition, operating performance, financial performance, cash flows, its access to finance or cost of capital over the short-, medium- or long-term, or investor decisions, and they include climate-related risks, supply chain disruptions, or labour practices might directly impact a company’s profitability and market value.

Impact Materiality

This dimension takes a broader view of ESG related issues by assessing how the company’s operations, products, and services impact society and the environment. Here, the focus shifts to considering the company’s impacts on the environment and people, including contributions to societal challenges such as climate change, social inequality, and biodiversity loss. By examining outward impacts, companies can better understand their role in driving positive change.

Impact materiality is at the heart of identifying ESG Value, Risks and Opportunities.

In general, an organisation should begin with an assessment of environmental and social impacts, whether or not they are financially material, to help stakeholders understand the overall sustainability performance. Although there may also be material risks and opportunities that are not related to the undertaking’s impacts, for example, the impact of changing weather patterns due to climate change.

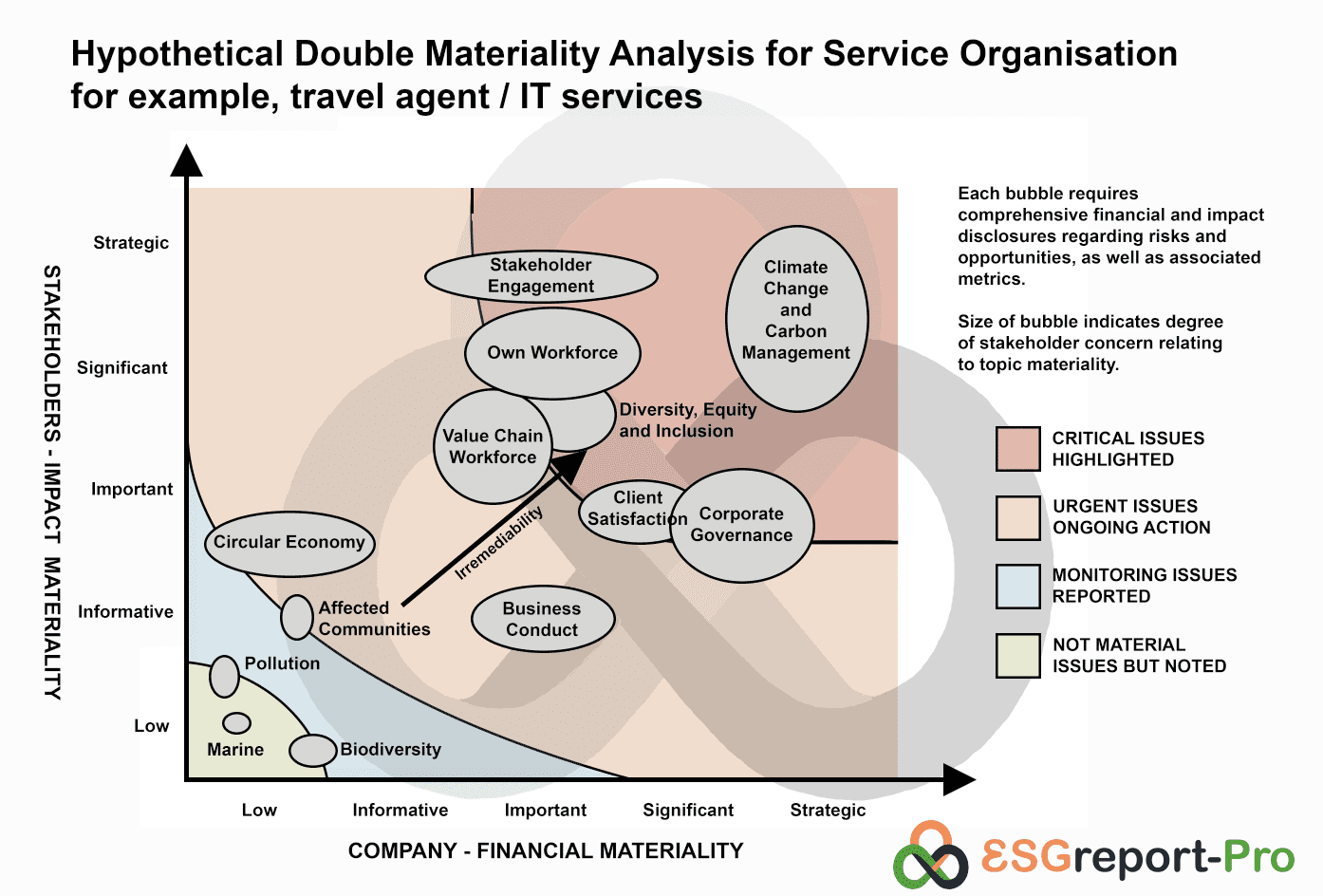

Low, Informative, Important, Significant and Strategic Materiality

Double materiality is therefore a concept that considers both the financial impacts of environmental and social issues on a company, as well as the impact of the company’s activities on the environment and society. Impacts should be categorised as LOW, INFORMATIVE, IMPORTANT, SIGNIFICANT or STRATEGIC to identify greater materiality to the organisation and therefore reported.

Once a matter has been identified as material, the undertaking refers to the requirements in the respective topical ESRS to identify the information to be disclosed on the matter. For example, health and safety could be material from a negative/positive impact, and/or risk, and/or opportunity perspective. If an undertaking concludes that health and safety of its own workforce is material, it shall provide information in Disclosure Requirements S1-1 Policies, S1-4 Taking action, S1-5 Targets, and S1-14 Health and Safety metrics. Similarly, if an undertaking concludes that pollution of water is material, it shall provide information in Disclosure Requirements E2-1 Policies, E2-2 Actions and resources, E2-3 Targets, and E2-4 Pollution of air, water and soil.

Double Materiality Also Applies to The Value Chain

Double Materiality also applies to the Value Chain, whereby the organisation needs to identify and assess impacts, risks and opportunities to determine their materiality based on the nature of the activities, business relationships, geographies or other factors concerned.

Additionally, the organisation must consider how it is affected by its dependencies on the availability of natural, human and social resources at appropriate prices and quality, irrespective of its potential impacts on those resources.

What are the benefits of Double Materiality compared to only considering the financial impacts?

Embracing the double materiality assessment offers several benefits:

#1 Holistic Risk Management

By evaluating both financial and impact materiality, organisations identify and mitigate risks more comprehensively. This helps companies prepare for potential disruptions and uncertainties arising from ESG-related issues.

#2 Enhanced Stakeholder Engagement

Stakeholders, including investors, customers, employees, and communities, are increasingly interested in a company’s broader impact. A double materiality approach allows organisations to engage with stakeholders more effectively by addressing concerns that extend beyond financial performance.

#3 Long-Term Value Creation

Recognising the long-term consequences of societal impacts allows companies to develop strategies that create value for both shareholders and society. This can lead to sustainable growth and resilience in the face of changing market dynamics.

#4 Regulatory Compliance and Reporting

Many regulatory frameworks are beginning to incorporate the double materiality concept into reporting requirements. By adopting this approach, companies can ensure compliance and stay ahead of evolving reporting standards.

DETAILED GUIDES

Let's Dig In to Financial and Impact Materiality - How to Assess and Prioritise Materiality

Getting this part of your ESG reporting clear and coherent will make an enormous difference to why, what and how your ESG system gathers and manages data.

Overview of GHGe/ESG Management System Development

- Scoping – this is an initial outline of the sector and value chains that identifies possible hotspots, key stakeholders and maps key system actors.

- GHGe/ESG Inventory – through stakeholder engagement, identify all sources of GHGe/ESG impacts including sources, scale, intensity, irremediable character, metrics for quantifying impacts and possible goals/targets.

- Double Materiality Testing – assessment of financial and physical impacts associated with each GHGe/ESG Inventory item, including dependency on the source and assessment of Risks and Opportunities.

- Scenario modelling – build scenarios/forecasts that are deemed likely to materialise; and consider GHGe/ESG matters deriving either from situations with a below a “more likely than not” threshold.

- Definition of critical / important / negligible GHGe/ESG inventory items to be included in the management system and related Transition Plan to achieve your 2030 and 2050 targets of Net Zero emissions or ESG Best Practice.

- Definition of Monitoring and Evaluation metrics and targets for each item and build appropriate reporting system/software.

OK, let’s get some perspective on impacts and take a closer look at Financial and Impact Materiality, commonly called Double Materiality assessment.

Assessing Financial Materiality

ESG Report Pro guides you through your financial materiality assessment by first asking you to identify risks and opportunities that affect, or could reasonably be expected to affect, the organisation’s financial position, financial performance, cash flows, access to finance or cost of capital over the short-, medium- or long-term. The financial materiality of a sustainability matter is not limited to matters that are within the control of the organisation but includes information on material risks and opportunities attributable to business relationships beyond the scope of consolidation used in the preparation of financial statements. In this context, the undertaking shall consider:

- the existence of dependencies on natural and social resources as sources of financial effects as they may influence the undertaking’s ability to continue to use or obtain the resources needed in its business processes, as well as the quality and pricing of those resources; and

- if any dependencies may affect the organisation’s ability to rely on relationships needed in its business processes on acceptable terms.

Financially material matters need to be classified as:

(a) risks that may contribute to negative deviations in future expected cash flows and/or negative deviation from an expected change in capitals not recognised in the financial statements; or

(b) opportunities that may contribute to positive deviation in future expected cash flows and/or positive deviation from expected change in capitals not recognised in financial statements.

Once you have identified your risks and opportunities, you need to determine which of them are material for reporting over the short-, medium- and long-term based on a combination of (i) the likelihood of occurrence and (ii) the potential magnitude of financial effects determined on the basis of appropriate thresholds. We recommend that you build scenarios/forecasts that are deemed likely to materialise; and consider sustainability matters deriving either from situations with a below a “more likely than not” threshold or assets/liabilities not, or not yet, reflected in financial statements. This includes:

- potential situations that following the occurrence of future events may affect cash flow generation potential;

- capitals that are not recognised as assets from an accounting and financial reporting perspective but have a significant influence on financial performance, such as natural, intellectual (organisational), human, social and relationship capitals; and

- possible future events that may have an influence on the evolution of such capitals.

Sound complicated? Here are a few examples of how impacts and dependencies are sources of risks or opportunities:

- when the undertaking’s business model depends on a natural resource – for example water – it is likely to be affected by changes in the quality, availability and pricing of that resource;

- when the undertaking’s activities result in negative impacts, e.g., on local communities, the activities could become subject to stricter government regulation and/or the impact could trigger consequences of a reputational nature. These might have negative effects on the undertaking’s brand and higher recruitment costs might arise; and

- when the undertaking’s business partners face material sustainability-related risks, the undertaking could be exposed to related consequences as well.

Assessing Impact Materiality

ESG Report Pro will guide you through the full process, but here’s an outline.

In assessing impact materiality and determining the material matters to be reported, the organisation must follow three steps:

- Understand the context in relation to its impacts including its activities, business relationships, and stakeholders;

- Identify actual and potential impacts (both negative and positive), including through engaging with stakeholders and experts. In this step, the undertaking may rely on scientific and analytical research on impacts on sustainability matters;

- Assess the materiality of its actual and potential impacts and determine the material matters. In this step, the undertaking shall adopt thresholds to determine which of the impacts will be covered in its sustainability statement.

The severity of impacts is determined by the following factors:

- Scale: how grave the negative impact is or how beneficial the positive impact is for people or the environment;

- Scope: how widespread the negative or positive impacts are. In the case of environmental impacts, the scope may be understood as the extent of environmental damage or a geographical perimeter. In the case of impacts on people, the scope may be understood as the number of people adversely affected; and

- Irremediable character: whether and to what extent the negative impacts could be remediated, i.e., restoring the environment or affected people to their prior state.

Any of the three characteristics (scale, scope, and irremediable character) can make a negative impact severe. In the case of a potential negative human rights impact, the severity of the impact takes precedence over its likelihood. As a quick guide, the ESRS dictates that a group of products and/or services offered, a group of markets and/or customer groups served, or an ESRS sector, is significant for the undertaking if it meets one or both of the following criteria:

(a) it accounts for more than 10 per cent of the undertaking’s revenue;

(b) it is connected with material actual impacts or material potential negative impacts of the undertaking.