Clarity from Chaos? – How Tipping Points Change Everything

I’m not the sort of person who scares easily, maybe that’s why I struggle to buy into warnings of calamity and the like. I like to think I can take things as they come, but lately I feel that maybe my ambivalence is fading, or perhaps, I am actually beginning to feel overwhelmed. It might be the cacophony of catastrophic predictions, the call-outs from resource-poor sustainability professionals suffering from a tsunami of expectations, or that nagging feeling that things are far from stacking up in favour of common sense…

Time to take a reality check. Time to take a little time to realise the importance of time. Somewhere along the road I saw a formula that tried to explain ESG value generation, it seems to me that it can be useful now.

ESG Value Generated = Skills + Time

The value created by a business is a combination of the skills possessed by individuals and the time they spend utilising those skills, which implies that having a talented workforce is important, but so is ensuring that they are given sufficient time to apply their skills effectively. Over time, we create value by honing skills and developing new ones. Sometimes we dither about but in general we make progress. In other words, we’ve taken the incremental approach to change, a bit at a time and giving it time. Which is fine, on the condition there isn’t something big and serious and nasty breathing down your neck.

Apparently, and according to a lot of folks, there is more than one thing that’s big and nasty, climate change and biodiversity loss are but two monsters that we currently face. Whether you agree or not, there are enough folks in governments who do believe this, so they have done something that is not incremental.

It’s about the +

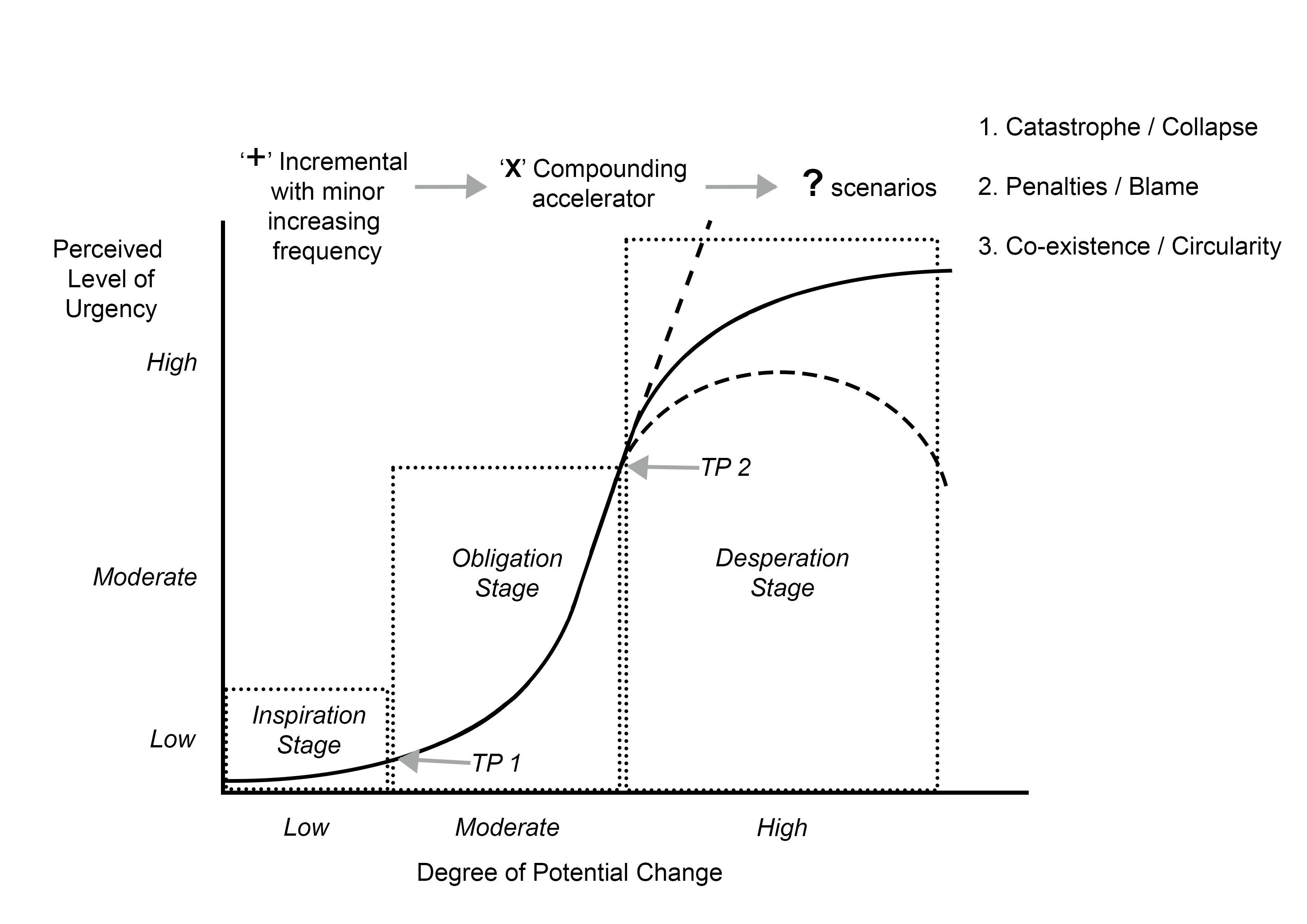

But first, can I point out that the incremental approach is characterised by the sum of skills and time. It’s the time-honoured craftsmen approach, let nature take its course, organic-inspiration stage when early adopters are excited and considered to be outside of the main-stream. For the majority of folks, this period of time carries little or no urgency for any change at all and has covered the last 30+ years of voluntary sustainability reporting systems designed for those who wanted to dial-in to specific issues. A few companies, a few people, limited resources, but for the vast majority it passed them by, incrementalism at its most typical.

Then something happened. The whys and wherefores are not important because it has happened and the world has changed. Be in no doubt, when the European Union passed a law, the Corporate Reporting Sustainability Directive, it was a tipping point. We have just stepped out of inspiration into obligation, and the world is no longer incremental, well, not for long anyway. And our value generation formula is going to change for a number of reasons.

ESG Value Generated = Skills X Time

ESG standards have arrived and they have caused wholesale panic. That happens when things change, folks run about, some to the hills, some in circles. Unsurprisingly, ESG practitioners are suffering fatigue as they have just been thrown into the mosh-pit of business. No longer an outlier, they are now being scrutinised and carry a heavy burden of responsibility, but mostly with the same limited resources that they had before. Somehow, they have to derive transition plans that cost nothing (or are even profitable), design mitigation plans that the marketing department can swoon over, and somehow transform, upscale and disseminate ESG practices into competitive advantages, or at least not incur fines or prison sentences for the directors.

But this also means that the same budgeting and strategy arguments can now be applied to ESG departments, in other words, they can use the multiplier. Now the ESG value generated by a business is directly proportional to the skills employed and the amount of time invested. In other words, the more skilled individuals you have working for your business and the more time they dedicate to their work, the greater the value that can be created. Now they need to scale themselves, and to start, I recommend using all the same arguments that marketing used long ago: media plus communications, add some branding and there will be an increase in sales. It’s a tried and tested formula, but now ESG performance and not cute babies are the attention grabber.

The Impact of Tipping Points on the Perceived Urgency for Potential Change

Source: Author

I hear shouts of shock and horror! How can we apply Porter’s P’s to ESG? To start with, I think that approach is what everyone else in the organisation understands and will respond to more positively than otherwise. I wish it were different, that somehow you could instantly generate an understanding of circularity and transformative growth throughout your organisation. But you can’t and probably won’t be able to until the Obligation Stage is in full swing… and that will take time.

Secondly, you already have some tailor-made arguments at your disposal to justify an increase in resources, it may involve office politics, but as it is likely some key competitors are further along the path than you, it shouldn’t take too long for the Board and senior management to re-prioritise. It’s a hang-in-there approach, but that’s how marketing and advertising increased their budgets.

Where to now?

Moving forward, ESG practitioners will have to focus on developing adaptive processes that don’t cost the earth or mean divesting cash cows. At the same time, you’ll be expected to gradually integrate mitigation strategies, which potentially can be cheaper than business-as-normal and harness innovation to re-imagine, invent, patent, and manufacture technologies that can become the source of new competitive advantages to generate profit. So yes, you do need more resources, desperately!

Hopefully, ‘profit’ also gets a revamp along the way too, that could take us all on a best-case scenario, co-existence with nature and circular economic systems that create long-term, resilient growth. That’s neither just a bunch of words or a pipe-dream anymore, there is a huge body of work that details precisely how this can happen, and without mass unemployment, excessive taxation and reducing individual freedoms.

That’s the up side, and it’s a way off. A more likely scenario is that we are heading for a bumpy time in the Desperation Stage.

The Good, The Bad and The Ugly

Of the three scenarios that we face, two of them are not good. In fact, one is downright bad. The Desperation Stage will happen after another tipping point, but we don’t know what it will be or when it is likely to occur. That’s the problem with all this future stuff, it’s really, really hard to predict… but it is a very good bet that something will happen that will shift public perception from moderately concerned to very concerned about changing the way we do things. Politicians will follow quickly as they will see the dual benefits of votes and generating fines to help the treasury.

As for catastrophe and collapse, well, that’s the scenario that I see flying around the internet and I can’t help feeling that we need more information to help folks stretch for the co-existence option.

The bottom line as I see it is, Hang in There, we’ve just passed a tipping point and things move quickly when that happens. Just like rafting down a river, we’re in some white water, and we need some more hands on the oars. It’s the immediate priorities that need to be addressed – due diligence, governance and stakeholder engagement – and that should be more than enough to justify asking for more resources, maybe even a sector-specific consultant or two. We all know that things are changing, but that’s all we know right now. Try to master your ESG-anxiety and get paddling hard.

This post also appears on the ESG LinkedIn page: https://www.linkedin.com/pulse/clarity-from-chaos-how-tipping-points-change-everything-djhse

For more articles see our ESG Blog: https://esgreportpro.com/esg-blog/