A Lesson From Bhutan

There seems to be an awful lot of information floating about concerning the theoretical purpose and utility of ESG issues these days. A few voices try to be heard that champion context ahead of materiality but the clamour of rather insubstantial advice is pretty overwhelming. So, I thought I’d share a real-life story to try and create some space for reflection amongst the cacophony of text-book theories.

The Field

I was standing in a field in Bhutan. Next to me stood a businessman outlining his vision for his new office. It was all sounding very familiar, he talked about staff and workstations and where the water pipe would be dug. And then he said something that I wasn’t expecting, ‘You must come to the ceremony when we cut the ground.’ I asked him to explain what he meant. ‘The earth does not belong to us, I only have the opportunity to use this place for building an office, but the earth is alive and must be respected. In Bhutan we always ask for permission from the earth before we cut it. And then when we lay the foundation, we make sure that it is purified and adds value to the earth, we have another ceremony for that as well.’ He went on to describe different ceremonies at different stages of construction and as he spoke, I began to feel the duality of the world in which he lives each day. On the one hand, the function and purpose of day-to-day life, and on the other, a deeper sense of value that forms the foundation of meaningfulness in what and why he does what he does.

I stood looking at the ground and imagining the gradual process of construction, something that we are all very familiar with, wherever we live. But I knew that for the businessman the process would not be the same than if it had been me undertaking the same project. His project would have more depth, more meaningfulness than mine. I would simply have a building, which I would be happy about, but he would have a building that was part of the landscape in a physical and spiritual sense.

The parallel with my work in ESG systems and reporting struck me. How often I simply referred to metrics and indicators, relied on theory and frameworks rather than taking a little time to delve deeper. As time goes by, I realise more and more that it is the hidden meaning that is often the fundamental driver to value and those companies that take the time to find and understand it are often the most successful.

ESG and Meaningfulness

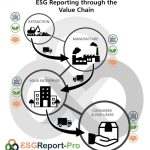

It’s crucial to understand the interplay between the qualitative and quantitative aspects of corporate responsibility and sustainability. However, the focus on utility and purpose within ESG reporting often overshadows the deeper significance of meaningfulness and the values that bind together and drive forward organisations, and the hidden opportunities that should be at the core of a broader conversation around corporate sustainability.

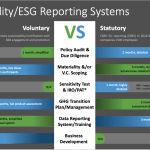

ESG reporting serves as a framework for companies to disclose their performance. Like every framework however, it needs ‘flesh’, otherwise it is just a bare framework. The flesh is context and depth, it’s the stuff stakeholders, including investors, consumers, employees, and communities, are interested in. It’s the flesh that allows stakeholders to decide if they are interested in what you do and then assess the long-term value and sustainability of their engagements with your company.

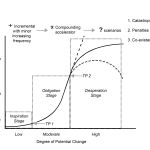

As the ESG landscape continues to evolve, the emphasis on utility and purpose has become predominant. I’m going to take utility to refer to the practical usefulness of ESG reporting, such as its role in risk management, cost reduction, and attracting investment. Purpose revolves around the broader intent of ESG reporting, including fostering corporate responsibility, mitigating environmental impact, and enhancing social welfare. While utility and purpose are undeniably critical, the concept of meaningfulness tends to be lost or overlooked.

Meaningfulness in ESG reporting encompasses the depth and authenticity of a company’s commitment to sustainability and ethical conduct. It goes beyond mere compliance with regulations and industry standards, delving into the actual impact of the company’s initiatives on the environment, society, and governance structures. Meaningfulness involves the integration of ESG principles into the core values of the organisation, aligning them with the company’s mission and long-term strategy. It requires a genuine dedication to effecting positive change, rather than engaging in superficial or performative actions solely for the sake of compliance or public relations. Meaningfulness is often the real reason why your staff come to work, why your suppliers try to make you stronger and why your customers continue to choose you rather than someone else.

The Greenwashing Habitat

One of the primary reasons meaningfulness is often overshadowed in ESG reporting is the prevalence of greenwashing and superficial ESG initiatives by companies who see sustainability as merely a reporting obligation and an easy market advantage. It is scary how many organisations nominate a junior as their sustainability manager, or allocate ESG reporting tasks to an administrative function. It’s understandable that most managers are focused on finessing their role in the name of operational efficiency and competitiveness but this creates the perfect habitat for greenwashing and social-washing. Such organisations seem intent on diverting attention from deeper, more meaningful sustainability efforts that are necessary for resilient growth, creating positive impacts and innovation. Similarly, superficial ESG initiatives, which prioritise optics over substance, can lead to a focus on utility and purpose at the expense of meaningful impact management.

Moreover, the current emphasis on metrics and standardisation in ESG reporting can inadvertently detract from meaningfulness. While metrics are essential for quantifying and comparing ESG performance, they often fail to capture the nuanced and qualitative aspects of a company’s sustainability efforts. As a result, companies may prioritise activities that yield favourable metrics, even if they lack meaningful impact, thus perpetuating the disconnect between utility and meaningfulness.

Another challenge is the short-term mindset that pervades corporate decision-making. In a landscape where quarterly results often take precedence, the long-term significance and meaningfulness of ESG efforts can be overlooked. Companies may opt for quick, high-visibility projects that yield immediate benefits, rather than investing in more comprehensive, albeit slower, initiatives that could yield deeper and more meaningful ESG impact over time.

Additionally, the pressure to meet stakeholder expectations and industry benchmarks can lead to a compliance-driven approach to ESG reporting. This approach, while serving the purpose of meeting minimum requirements, may inhibit companies from pursuing more meaningful and innovative sustainability strategies. As a result, the true essence of meaningfulness can become obscured by a focus on meeting external standards rather than internalising a commitment to holistic sustainability.

Take the Time to Find Meaningfulness

To address these challenges, it is crucial to integrate meaningfulness into the core of your ESG reporting practices. This can be achieved through several key strategies but it begins with redefining your approach to governance – begin with the intent to find meaningfulness in what you do and if you don’t find it then be sure to create some. It is essential to have a commitment to transparency and authenticity throughout your stakeholder engagement process and subsequently in your ESG reporting. The businessman in Bhutan was always sure to include everyone, even the land itself in the process, for him it was an extension of his culture and identity. For me, I now prioritise establishing clear and comprehensive information about the company’s sustainability initiatives, including successes, failures and challenges. Honest and transparent reporting is essential for building trust with all stakeholders and demonstrating a genuine commitment to meaningful ESG practices.

Furthermore, integrating meaningfulness into ESG reporting requires a shift in mindset—from a focus on short-term gains to a long-term perspective. Companies should prioritise initiatives that may not yield immediate gratification but have the potential to generate substantial and lasting positive impact. This shift in mindset necessitates a re-evaluation of performance metrics to accommodate the qualitative aspects of meaningfulness, in addition to the quantitative measures of utility and purpose.

In addition, fostering a culture of meaningfulness within organisations should be seen by senior management and the Board as essential. This involves embedding ESG principles into the company’s values, mission, and day-to-day operations. Ultimately, we all need to get better at looking beyond utility and purpose to find the hidden meaningfulness that drives and motivates us. When sustainability becomes an intrinsic part of a company’s identity, meaningful ESG efforts are more likely to take root and flourish, and that is better for us and the planet.

Click here for more information on how to begin your ESG reporting process.